Stay Informed with Time & Pay

By Andrew Scheu

•

August 20, 2024

Discover the latest technology for managing employee time punches and time cards, and learn how to streamline your time management while protecting your business. From geo fencing to mobile applications, these intuitive features can revolutionize your operations and enhance accountability.

By Andrew Scheu

•

August 19, 2024

Discover the benefits of automated timekeeping for small businesses and why you should consider making the switch to boost efficiency, save time, streamline payroll, and cut down on labor costs. Embrace modern technology and propel your business forward with automated timekeeping solutions tailored for small businesses.

By Andy Scheu

•

July 10, 2024

What's New? The U.S. Department of Labor (DOL) has announced an important update to the salary threshold for overtime-exempt employees, which takes effect on July 1, 2024. This change impacts employers and employees nationwide, and it’s crucial to understand the new requirements to ensure compliance with federal labor laws. Overview of the New Salary Threshold The updated rule increases the salary threshold for white-collar exemptions under the Fair Labor Standards Act (FLSA). This affects executive, administrative, and professional employees who are exempt from overtime pay. Key Details: Previous Threshold: $35,568 annually ($684 per week) New Threshold (Effective July 1, 2024): $43,888 annually ($844 per week) Employees earning less than this new threshold will be entitled to overtime pay for hours worked over 40 in a workweek, regardless of their job duties. What Employers Need to Know 1. Review Employee Salaries Employers must review the salaries of all currently exempt employees to determine if they meet the new threshold. Any employee earning less than $43,888 annually will no longer qualify for the overtime exemption. 2. Update Payroll Systems Ensure that your payroll systems are updated to reflect the new salary threshold. Accurate overtime pay calculations are essential for compliance with the updated DOL regulations. 3. Consider Salary Adjustments or Reclassifications Employers may need to decide whether to increase the salaries of employees close to the threshold to maintain their exempt status or reclassify them as non-exempt and pay overtime. 4. Enhance Time-Tracking Procedures Implement or upgrade time-tracking systems to accurately monitor hours worked by non-exempt employees. This ensures that all overtime hours are correctly recorded and compensated. 5. Communicate Changes to Employees Clearly communicate these changes to your employees, explaining how the new threshold impacts their status and compensation. Training managers to understand and manage these adjustments is also recommended. Benefits of Compliance Avoiding Penalties Compliance with the new rule helps employers avoid potential fines and legal actions associated with non-compliance. Employee Satisfaction Transparent communication and fair compensation practices can enhance employee morale and retention. Operational Efficiency Proper classification and tracking can lead to more efficient workforce management. Conclusion The new DOL salary threshold for overtime exemption is a significant change that employers need to address promptly. By understanding the new rule, updating payroll systems, and effectively communicating with employees, businesses can ensure compliance and maintain a positive workplace environment. For more detailed information about the new rule and its implications, visit the Department of Labor’s website . URLs: Department of Labor: Overtime Rule Fair Labor Standards Act (FLSA) Webinar w/ SESCO Management Consultants

By Andy Scheu

•

February 8, 2021

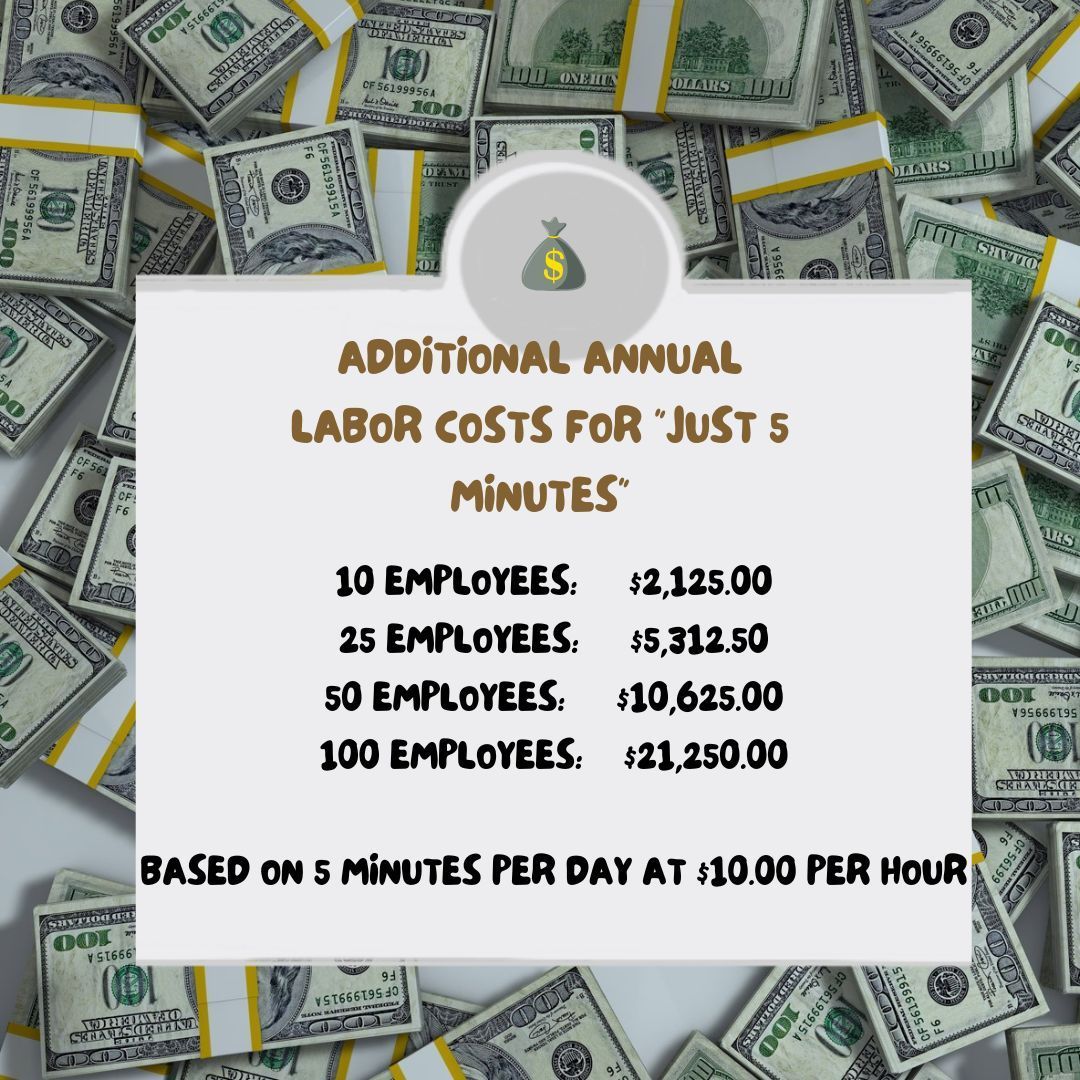

Question: How do I reduce labor costs? Answer: Accurately track employee time down to the minute. “It’s Only 5 Minutes!” is often what employers think when considering their employees’ time cards, but what is “It’s only 5 minutes” really costing you? The cost of using timesheets can grow into something substantial, especially if they aren’t accurate. If you’re asking yourself “how do I reduce labor costs,” you may want to consider these questions, as well: How often are your employees’ times fudged by 5 to 10 minutes? If you are using a time clock/time cards, how often are the totals rounded off just a little for ease of calculating? How often are mathematical errors made in tabulating hours worked? How often are employees forgetting to clock in or out with omissions inaccurately reported days later? These little errors occur more often than you think while also costing your company a significant amount of money! Chances Are Your Employees Are Being Over Paid! After many extensive studies by the American Payroll Association and many other businesses nationwide, it has been determined that employees are overpaid from 1% to 8% of their annual wage. This is simply due to the errors that commonly occur in manually recording and calculating hours worked. Therefore, “It’s only 5 minutes” adds up quickly. The table below shows what a miscalculation of “just 5 minutes” (1%) a day per employee is costing your company annually.

By Andy Scheu

•

October 10, 2019

Are Your Employees Now Eligible for Overtime? With the new overtime rule going into effect in 2020, employers are looking for ways to keep labor costs low, while remaining compliant with Department of Labor regulations. One strategy being considered is the Fluctuating Workweek method. While this method is effective in reducing labor costs associated with overtime, employers should know all of the requirements before deciding to use it. What is the Fluctuating Workweek Method? Under the fluctuating workweek method, non-exempt employees (employees eligible for overtime pay) receive a fixed weekly salary. They are paid this salary regardless of the number of hours that they actually work. In the fluctuating workweek method, the base rate of pay is calculated by dividing the fixed weekly salary by the number of hours actually worked that week. If the employee does work over 40 hours in a week, they will be paid 0.5 times their base rate of pay for each overtime hour. This is instead of 1.5 times their regular rate of pay, as required by the Fair Labor Standards Act normal method of calculating overtime. In order to ensure compliance with the fluctuating workweek method, it is important that employers accurately track their employees’ time . An automated timekeeping system will make tracking hours easy for employees and employers, and can automatically calculate the base rate and overtime pay. What Are the Requirements? There are some requirements that must be met before an employer can use the fluctuating workweek method. The employee’s hours actually worked must fluctuate from week to week. The employee must receive the same weekly salary regardless of hours actually worked. There must be a clear (and ideally written) understanding between the employer and employee as to how they will be paid. The employee must work in a state where the fluctuating workweek method is not prohibited (Alaska, California, New Mexico, and Pennsylvania employees are not eligible). If these requirements are not met, employers must pay employees 1.5 times the regular rate of pay for each overtime hour worked. If the new overtime rule will affect your business, and you would like to consider the fluctuating workweek method, Time & Pay can provide tools to help you manage your labor costs, and help keep you compliant with DOL regulations.