Stay Informed with Time & Pay

By Andy Scheu

•

March 25, 2024

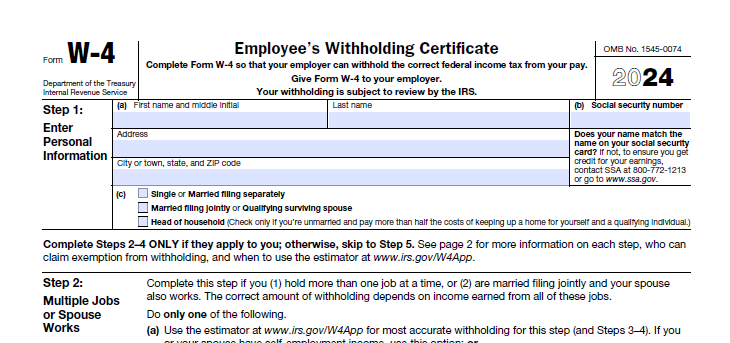

What’s New? Does your organization encourage annual W4 reviews? Each year, employers are forced to have tough conversations with employees that owe more taxes than expected after they file their return. While the employer is responsible for withholding and filing payroll taxes on their employee’s behalf, it is up to the employee to determine how much federal income tax is withheld from their wages. It is also the employee’s responsibility to make sure enough income tax is being withheld to cover their annual tax burden. What Should You Do? The amount of federal income taxes withheld from employee wages is determined by how they fill out their W4 . All employees are required to complete a W4 during the initial onboarding process, but very few review and make adjustments. For this reason, we recommend that employers actively encourage their employees to take these steps each year: Use the IRS tax calculator to get an idea of what tax liabilities will be for the year. Review check stubs to make sure enough federal and state income taxes are being withheld. Submit a new W4 if income tax withholdings are insufficient. Employers should also encourage employees to submit a new W4 if they: Experience a life-changing event (marriage, children, divorce, etc.). Add another source of income (2nd job, “side hustle”, contract work, etc.) Have had to pay additional taxes after filing their annual return for previous year. How Can Time & Pay Help Detailed Check Stubs: Time & Pay provides detailed earning statements for all employees we process payroll for. Paychecks that we produce include a check stub that shows all wages, deductions, and taxes withheld on the current payroll, as well as year-to-date totals. If your employee isn’t receiving a paper check, check stubs are sent via mail, or electronically to the employer to distribute. If the client is a Payentry subscriber, check stubs are available online through an employee self-service portal, as well as details about how their withholding status is currently set up. There is also a mobile app available on Apple and Android devices that give employees access anywhere they have internet access.

By Andy Scheu

•

May 25, 2023

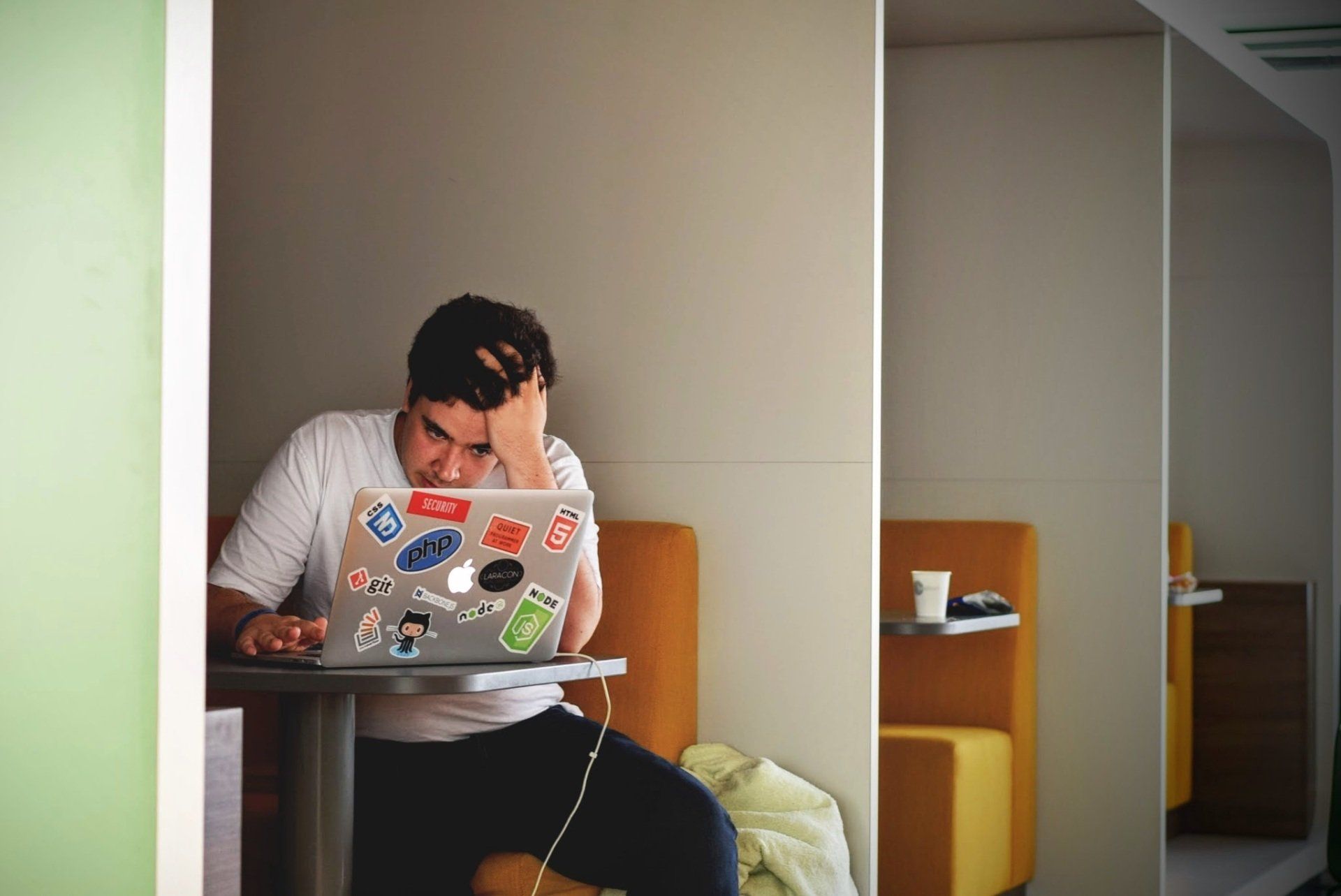

What’s New? Time & Pay partners with ZayZoon to offer employee financial wellness tools to their clients. ZayZoon has been a leader in providing earned wage access to employees across the country since 2014. Recently, however, they have expanded their offerings to help put more money in their users’ pockets, and provide more resources to help improve their financial well being. What is Earned Wage Access? For those not familiar with earned wage access, it’s a service that provides employees with access to the wages they have already earned prior to their regularly scheduled check date. ZayZoon ‘s platform allows for employees in need to request funds through an online portal. If approved, money will be deposited into their account that day, and the total will automatically be deducted from their following paycheck. This process is automated with Time & Pay’s system so there are no manual entries, and there is zero risk to employers. Best of all, ZayZoon charges a $5 fee for each transaction, not a high interest rate that is typical amongst cash-advance establishments. What Else Does ZayZoon Provide to Employees? ZayZoon ‘s goal is to improve financial wellness for their partners and their employees. In addition to EWA, ZayZoon offers: Financial Education – Intermediate and advanced educational courses and articles are available to users. Topics include everything from opening your first bank account to building credit. Smart Insights – Employee portals connect with user banking data to provide deeper insights into spending behavior and cash flow. Tips are also provided to help users make better financial decisions. Customized Alerts – Notifications can help alert users when they are at risk of incurring minimum balance or overdraft fees based on billing and pay history. Cash Rewards – earned wages can be transferred to gas cards or gift cards at no cost, and users can receive up to a 25% bonus with each transaction. What Are the Benefits to Employers? A Forrester study found that 48% of employees who are stressed about their financial situation are more likely to consider leaving their current job. A Deloitte study found that 83% of employees indicate that financial stress impacts their productivity at work. In addition, the same study found that employees who experience financial stress take, on average, nearly six extra sick days per year. Bottom line, employee financial wellness tools reduce costs for employers related to lost productivity, hiring, and training. Time & Pay is proud to partner with ZayZoon in order to help put their clients and their employees in a better financial position. If you would like learn more about ZayZoon , and how to add their services to your employee benefits package, contact us today !

By Andy Scheu

•

February 26, 2019

Identify Phishing Emails The IRS has issued a warning about an increase in phishing email scams directed at payroll and HR personnel. The scams generally involve employee W2’s, direct deposit information, or wire transfers. If successful, these scams can cost your company and your employees thousands of dollars. Here is a description of each scam, and how to identify them. W2 Scam: The email will impersonate a company executive and request copies of employee W2’s, or a report that details employee social security numbers, home address, and salary information. Once the scammer has this information they will be able to file fraudulent tax returns and collect those employees’ tax returns. Direct Deposit Scam: The email will impersonate a real company employee, often an executive, and request that their direct deposit information be changed for payroll purposes. The bank account information that they provide will be for an account controlled by the scammer, and once payroll is processed, they will receive the impersonated employee’s wages. Wire Transfer Scam: The email will impersonate a company executive and is sent to the company representative in charge of wire transfers. The email will request that a wire transfer is made to an account that is controlled by the scammer. Other scams include fake invoices, gift card requests, and title escrow payments. Here is an example of a phishing email one of our employees, Teresa, received from someone impersonating me, Andy Scheu.

By Andy Scheu

•

October 30, 2018

What’s New? Employers are recognizing that financial stress is major factor when it comes to maintaining a positive and productive work environment. In fact, 28% of employees say that financial stress is a distraction for them at work . Stressed employees tend to have more health issues, have bigger problems with attendance, and lower levels of work engagement. All of this adds up to decreased productivity, higher turnover rates, and ultimately, lower profitability. In order to combat this, employers are searching for solutions that will reduce their employee’s financial stress, but won’t affect the company’s cash flow or complicate their payroll process . How We’re Helping To help, Time & Pay has partnered with ZayZoon , a company that allows employees to access their paycheck before payday. This service helps your employees pay bills on time and avoid overdraft fees, while providing an alternative to high-interest payday loans. Best of all, we offer this service is at no cost to the employer , and it is completely risk-free! Contact us today to learn more about how Time & Pay can help lower your employee’s financial stress, and increase your bottom line!