Question: How do I reduce labor costs?

Answer: Accurately track employee time down to the minute.

“It’s Only 5 Minutes!” is often what employers think when considering their employees’ time cards, but what is “It’s only 5 minutes” really costing you? The cost of using timesheets can grow into something substantial, especially if they aren’t accurate. If you’re asking yourself “how do I reduce labor costs,” you may want to consider these questions, as well:

- How often are your employees’ times fudged by 5 to 10 minutes?

- If you are using a time clock/time cards, how often are the totals rounded off just a little for ease of calculating?

- How often are mathematical errors made in tabulating hours worked?

- How often are employees forgetting to clock in or out with omissions inaccurately reported days later?

These little errors occur more often than you think while also costing your company a significant amount of money!

Chances Are Your Employees Are Being Over Paid!

After many extensive studies by the American Payroll Association and many other businesses nationwide, it has been determined that employees are overpaid from 1% to 8% of their annual wage. This is simply due to the errors that commonly occur in manually recording and calculating hours worked. Therefore, “It’s only 5 minutes” adds up quickly.

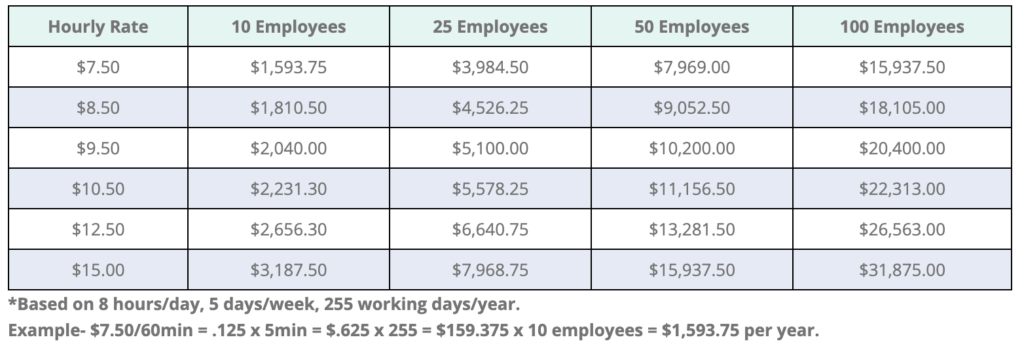

The table below shows what a miscalculation of “just 5 minutes” (1%) a day per employee is costing your company annually.

(Keep in mind these dollar amounts are just the cost of 5 minute (1%) errors in reporting, calculating and recording hours worked! These figures do not include the additional 30 – 40% average employee overhead and burden cost that all companies consequently experience. Nor do these figures include the cost of all the work involved in using and maintaining a manual timekeeping system!)

Accurate Timekeeping is Essential

In today’s competitive market, accurate timekeeping is essential to controlling your labor costs! Time & Pay provides you with a fully functional automated system that eliminates these hidden error costs by accurately calculating employees’ hours while helping to ensure they get paid only for the time they work. Our systems provide you with detailed time and attendance information that will help you easily monitor the attendance habits of your employees and control unproductive time with consistency.

In addition to this, our systems precisely determine your labor costs.

What does this mean for you?

You will get the tools you need to control and define your labor costs while eliminating all the work, errors and maintenance costs associated with manual timekeeping.

Best of all, this adds directly to your bottom line. Furthermore, Time & Pay’s automated timekeeping services give you the tools you need to better manage your business!

If you are asking yourself, “how do I reduce labor costs”, contact us today to see how we can help.