HR Management

Manage and empower your workforce

Key Benefits of Our HR Management Solutions

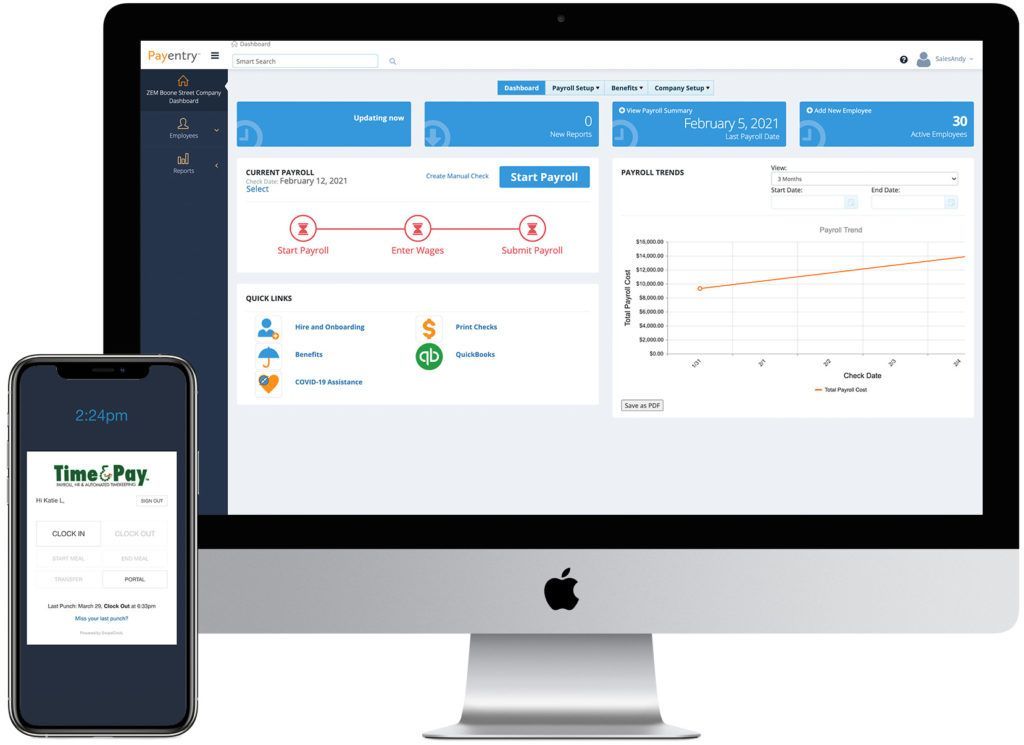

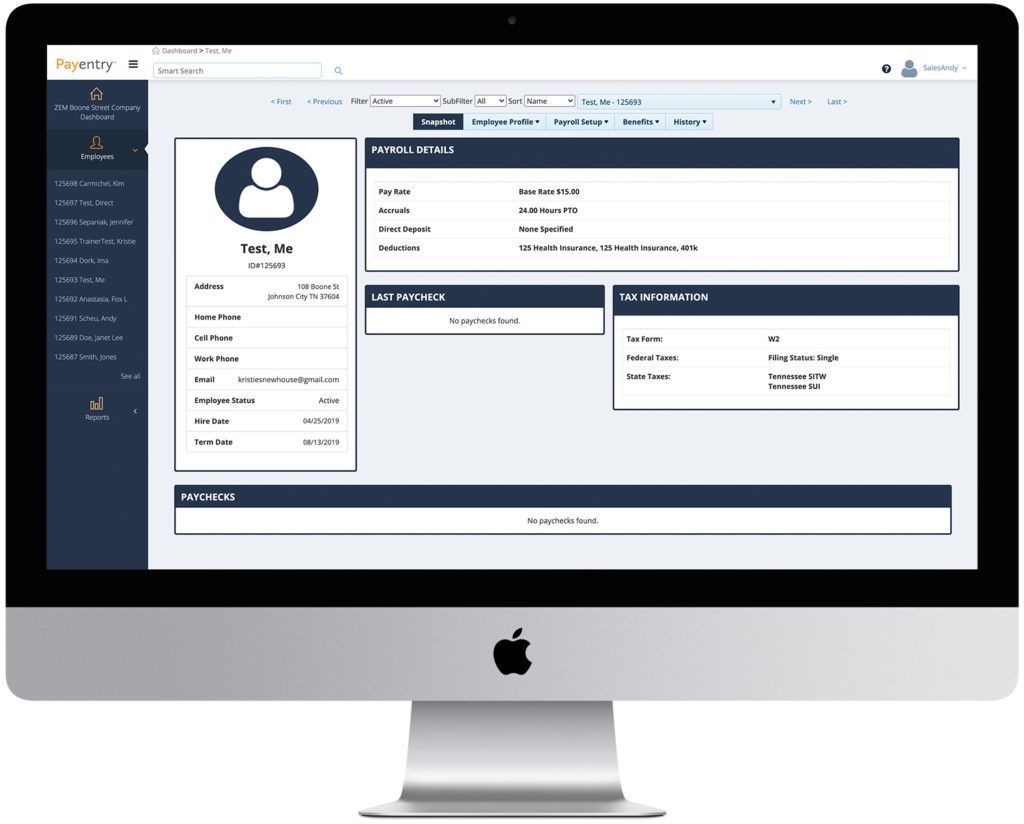

HRIS

Effortlessly monitor employee, payroll, and benefits information on-the-go. Track evaluations, salary changes, and key events to lead effectively.

PTO Management

Effortlessly manage employees' PTO requests and balances in accordance with your company's accrual policy.

HR Consulting

Receive free consultation and expert advice from qualified HR professionals to keep you and your organization out of trouble.

Hiring

Share job listings on various recruitment platforms and oversee candidates during the entire recruitment process.

Onboarding

Simplify onboarding by automating new hire data collection, E-Verify, background checks, WOTC screenings, and more.

Employee Self-Service

Empower your team with access to check stubs, tax docs, personal info updates, and benefits enrollment.

Your Partner in Payroll

Empower Your Employees

Get Pricing Today

Ready to simplify your payroll and HR processes? At Time & Pay, we tailor our services to meet your unique needs. Let us show you how we can add value to your business. Get a quote now and decide if you'd like to continue the conversation!

I was with ADP previously and have never regretted my decision of switching to

Time & Pay! They have been fantastic to work with and also quick to customize solutions for my business.

Dr. J. S., DMD, MPH, DHEd

FAQs

What is an HR Management System?

An HR Management System (or HRMS) helps employers manage essential employee functions, including:

- Gather new hire paperwork (W4, I9, etc.).

- Maintain employee records (personal information, pay history, etc.).

- Manage employee performance (reviews, raises, etc.).

What are the 5 core functions of HR?

There are five typical HR functions:

- Talent management

- Compensation and benefits

- Training and development

- Compliance

- Worker safety

How long do I need to keep employee records?

Record requirements vary depending on the type of information and the location of the business. The IRS requires employers to maintain records of employment taxes for 4 years, but you may want to consider maintaing all employee records for up to 7 years.

What forms are new employees required to complete?

Required forms will vary depending on your company policies and the state your employee will be living and working. Here is a checklist of items that your employee may be required to complete:

- W4 (required for all employees)

- I9 (required for all employees)

- State Tax Withholding Form

- Direct Deposit Form

- Employment Agreement

- Employee Handbook acknowledgement