Payroll Services

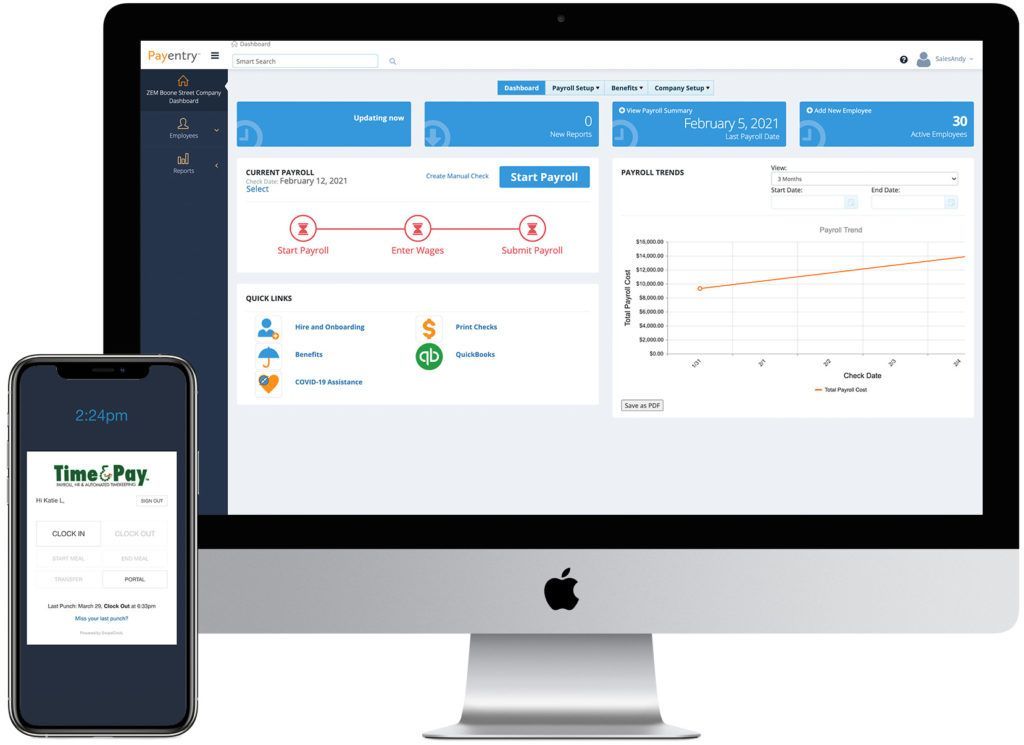

Tailored Processes for Simplified Payroll

Key Benefits of Our Payroll Services

Guaranteed Compliance

We handle all payroll tax filings - federal, state, and local - with guaranteed accuracy.

System Integration

We provide tailored import/export solutions with timekeeping and accounting systems (including QB Online) to streamline processes and reduce manual entries.

Simplicity

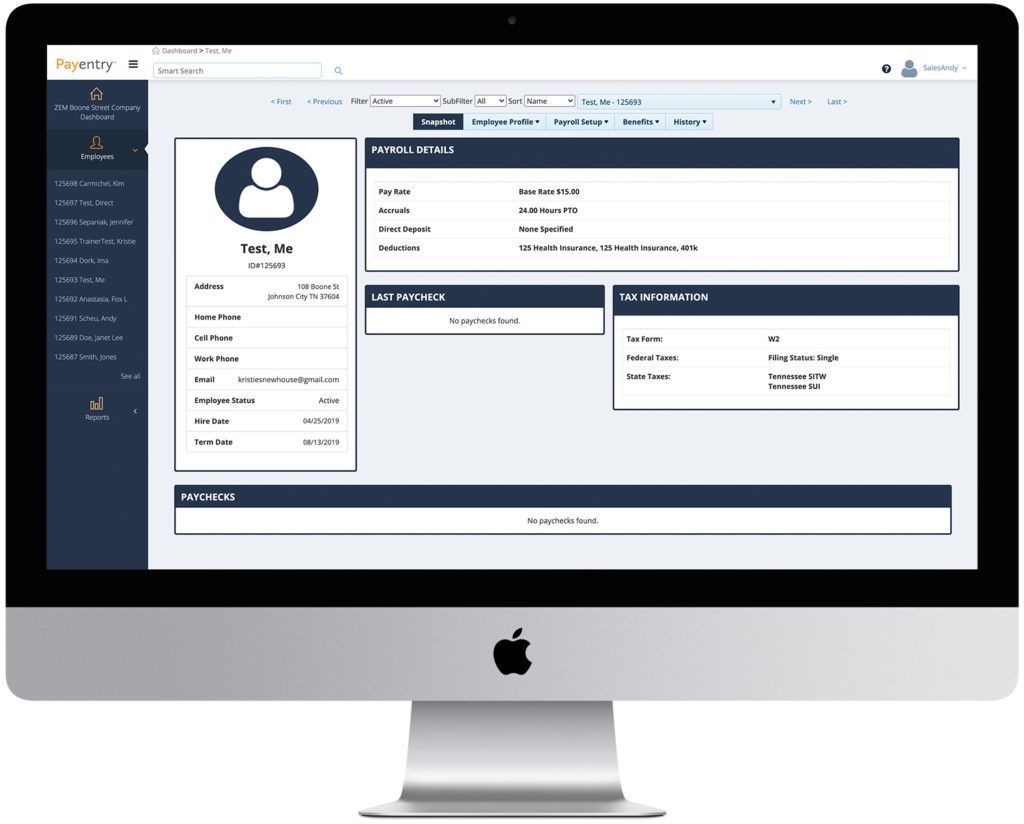

Our streamlined processes simplify platform interaction for a better user experience. Our commitment to efficiency ensures hassle-free experiences for customers.

Processing Options

Developing a payroll process with us will be efficient and tailored to your abilities and schedule.

Employee Pay Flexibility

We ensure timely payments via direct deposit, pay cards, and physical checks, with available earned wage access and bonus incentives.

Custom Reporting

We'll create custom reports to help you manage labor costs, benefits, retirement plans, workers comp, PTO, and deductions.

See How Simple Payroll Can Be!

The professional staff at Time & Pay are very easy to work with. They handle all of your government and state tax filings and are always ready to help with any problem or question that may arise. It is a pleasure to do business with you!!

Tony V.

Want to learn more? Sign up here for a free quote!

Provide info* to be directed to our quote calculator.

Why Choose Time & Pay?

Our competitors can serve as our most effective sales representatives. Discover the reasons why our clients have chosen to leave more prominent payroll companies in pursuit of superior customer service.

We Make Switching Easy

Consultation

We learn about your company, and what your ideal process looks like.

Information

We gather required information as efficiently as possible and try to minimize your time investment.

Confirmation

We'll confirm when we're ready to process, and work with you directly to ensure accuracy.

FAQs

How much do payroll services cost for a small business?

Get PricingThe cost of payroll services is typically based on the number of employees on payroll. Your pay frequency, your location, and the services that you utilize may also impact pricing. Time & Pay provides transparent pricing to help give you an idea of what payroll services will cost.

What's the best way to do payroll for a small business?

The best way to do payroll for a small business depends on your needs and budget, but you can consider outsourcing the process, using payroll software, or hiring a payroll specialist.

Regardless of whether you're processing payroll yourself, or using a payroll company, you'll still need these items:

- EIN and State Tax Accounts

- W4 and I9 for all employees

- Consistent pay frequency and check date

- Tax filing requirements and deadlines

- Record keeping requirements

Can a small business do their own payroll?

Though time consuming and often complicated, employers do have the ability to handle tax filings and returns through The Electronic Federal Tax Payment System (EFTPS), can pay employees via check, maintain employee records within their filing systems, and produce year-end forms for their employees without the assistance of a payroll processing company. More often than not, however, the peace-of-mind and time savings that outsourcing payroll responsibilities provides far outweigh the cost of those services. Non-compliance with tax and labor regulations can also be significantly more expensive than the cost of outsourcing payroll.

How do I process payroll for my business?

Regardless of who is doing it, processing payroll consists of the following steps:

- Track and record employee hours worked

- Calculate wages and withholding amounts (taxes, benefits, etc.)

- Distribute wages to employees

- Deposit the withheld taxes with appropriate government agencies

- File employer tax returns at the applicable deadlines

- Send employees Form W-2 and other required tax forms

What are the benefits of outsourcing my payroll?

Businesses usually outsource their payroll in an effort to save time, reduce labor costs, and maintain compliance with tax and labor laws. Payroll is not a revenue-generating aspect of your business, so the more time you spend on processing payroll, the less you are able to focus on growing your business. Outsourcing payroll can also offer peace-of-mind knowing that employees will be paid and taxes will be filed on time and accurately.

Are payroll requirements different for each state?

Each state can have its own tax requirements and labor laws. For example, certain states have state income taxes, while others do not. Regardless of where your company is located, Time & Pay can help keep you compliant with local regulations.