What’s New?

Does your organization encourage annual W4 reviews? Each year, employers are forced to have tough conversations with employees that owe more taxes than expected after they file their return. While the employer is responsible for withholding and filing payroll taxes on their employee’s behalf, it is up to the employee to determine how much federal income tax is withheld from their wages. It is also the employee’s responsibility to make sure enough income tax is being withheld to cover their annual tax burden.

What Should You Do?

The amount of federal income taxes withheld from employee wages is determined by how they fill out their W4. All employees are required to complete a W4 during the initial onboarding process, but very few review and make adjustments. For this reason, we recommend that employers actively encourage their employees to take these steps each year:

- Use the IRS tax calculator to get an idea of what tax liabilities will be for the year.

- Review check stubs to make sure enough federal and state income taxes are being withheld.

- Submit a new W4 if income tax withholdings are insufficient.

Employers should also encourage employees to submit a new W4 if they:

- Experience a life-changing event (marriage, children, divorce, etc.).

- Add another source of income (2nd job, “side hustle”, contract work, etc.)

- Have had to pay additional taxes after filing their annual return for previous year.

How Can Time & Pay Help

Detailed Check Stubs:

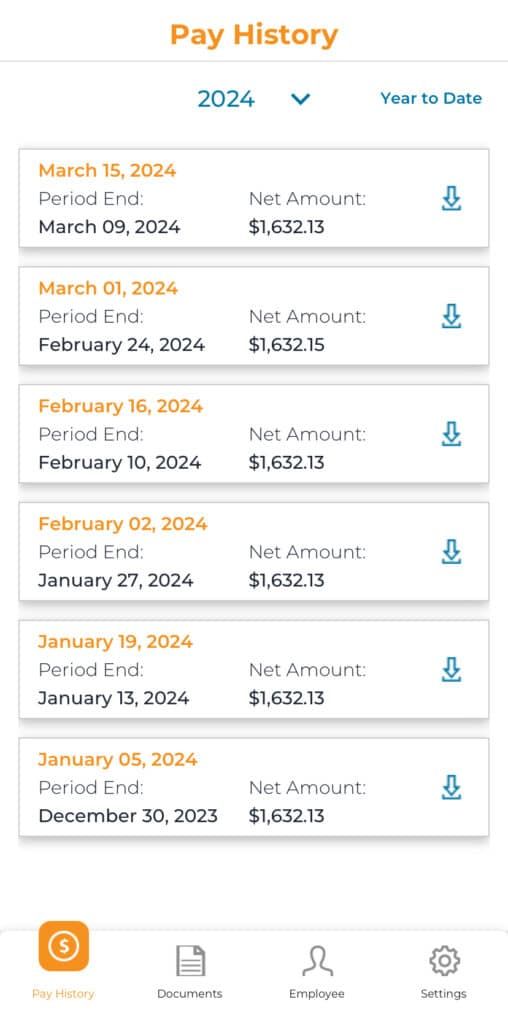

Time & Pay provides detailed earning statements for all employees we process payroll for. Paychecks that we produce include a check stub that shows all wages, deductions, and taxes withheld on the current payroll, as well as year-to-date totals. If your employee isn’t receiving a paper check, check stubs are sent via mail, or electronically to the employer to distribute. If the client is a Payentry subscriber, check stubs are available online through an employee self-service portal, as well as details about how their withholding status is currently set up. There is also a mobile app available on Apple and Android devices that give employees access anywhere they have internet access.

Onboarding:

Time & Pay provides an online onboarding system to all Payentry subscribers. New employees can complete their new hire forms, including their W4, through the online portal. Afterwards, employees are automatically added in payroll, and their withholding status is set based on the information they provided on the W4.

Summary:

Employers should educate and encourage their employees to review their check stubs regularly. If an employee’s personal or financial situation changes, they should understand that their W4 may need to be updated. If an employee has a complex financial situation, encourage them to seek guidance from an accountant or financial professional when completing their W4. The more you encourage your employees to be proactive when it comes to their taxes, the less you’ll have to worry about disgruntled employees each tax season.