Payroll Solutions for Greeneville, TN.

Simplify Your Work, Save Time, and Stay Compliant.

Why Choose Us?

Less than an hour away, Time & Pay has been providing payroll and HR solutions to local businesses and non-profits in Greeneville, TN for over three decades. Why collaborate with a global corporation when you can enjoy the same top-notch tools and services right in your own community?

Let's Connect!

We will get back to you as soon as possible.

Please try again later.

Your Partner in Payroll

Streamline Payroll and HR

1 Minute Overview

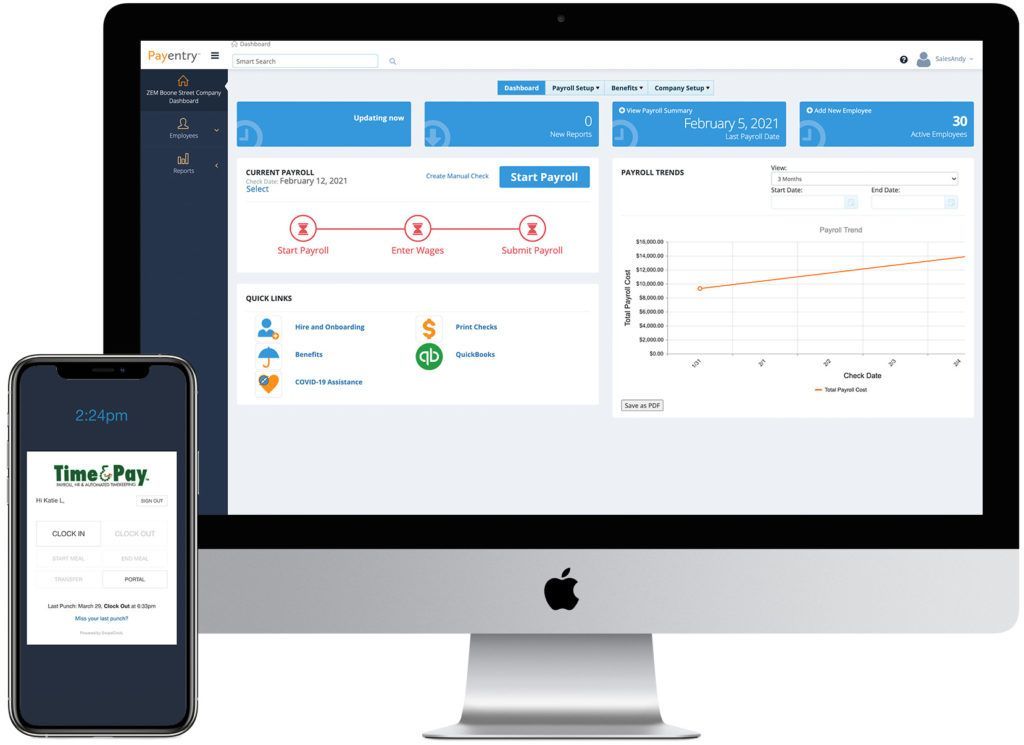

See how easy it is to process payroll through our online portal, Payentry!

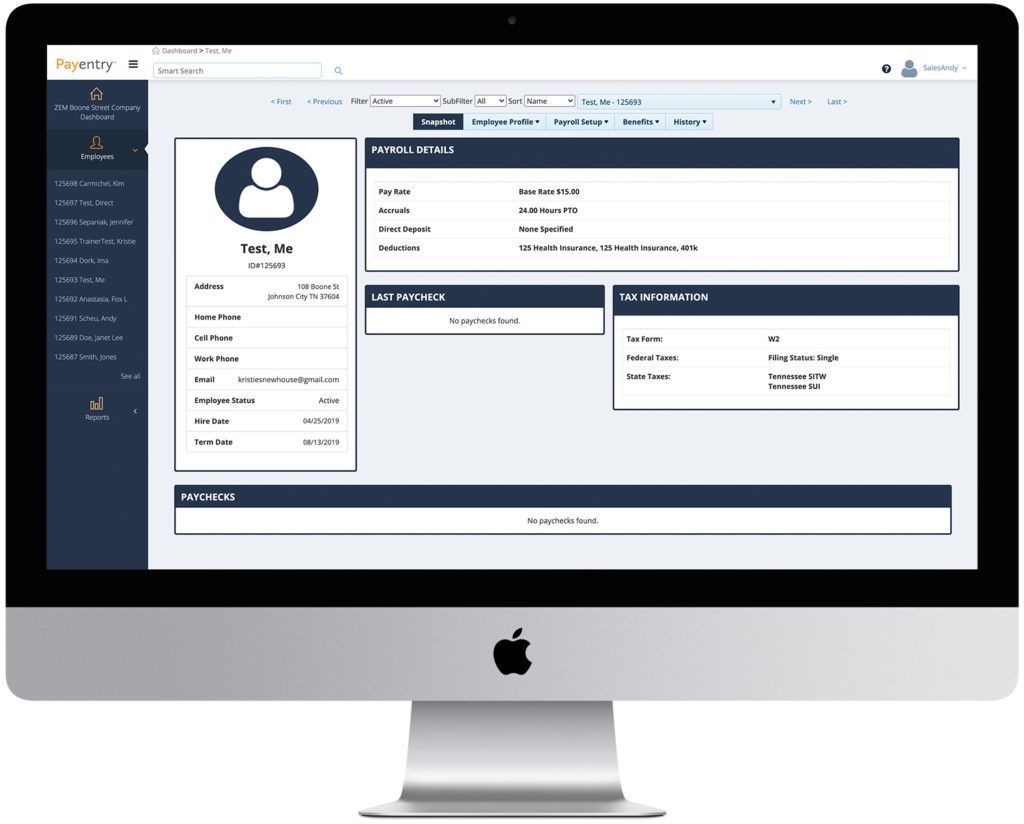

Onboarding Employees Made Easy

Watch how easy it is onboard new employees and get them ready for payroll!

Time & Pay saved us from hiring another employee to do our payroll. Along with providing great payroll services, they have given us the ability to easily track our labor costs for job costing.

Miles K. - American Calendar

Get Pricing Today

Ready to simplify your payroll and HR processes? At Time & Pay, we tailor our services to meet your unique needs. Let us show you how we can add value to your business. Get a quote now and decide if you'd like to continue the conversation!

Discover the Benefits of Our Payroll and HR Solutions!

Payroll & Tax Services

Efficient payroll processing tailored to your needs with guaranteed compliance.

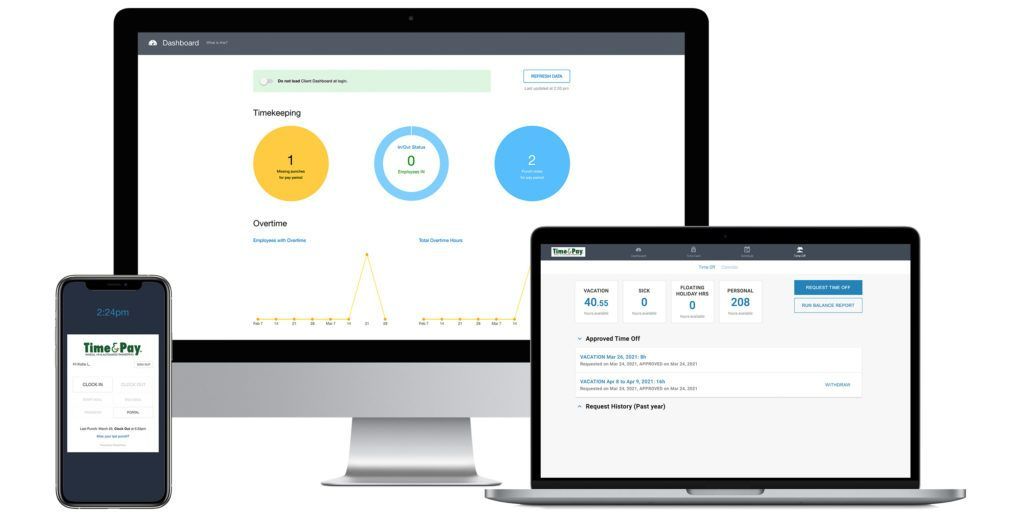

Time Management Systems

Human Resources Management

Cloud-based HR tools and complimentary consultation for your business.

Benefits & Insurance Management

Benefits enrollment, administration, and compliance tools

We Make Switching Easy

Consultation

We learn about your company, and what your ideal process looks like.

Information

We gather required information as efficiently as possible and try to minimize your time investment.

Confirmation

We'll confirm when we're ready to process, and work with you directly to ensure accuracy.

Contact us

Give us a call at 423-854-9042

108 N. Boone St.

Johnson City, TN 37604

Reception Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Time & Pay created a custom payroll import for me that has made payroll extremely easy. They have also helped keep me compliant in multiple states, and taken care of my workers comp reporting so that my audit goes smoothly. I highly recommend their services.

Bill S. - FedEx Contractor

FAQs

How Do I Find Your Office?

Take 321 North through Jonesborough, and past the Johnson City Medical Center. Merge right onto Deleware St., then left onto Main St. Take a left on N. Boone St. We are located in downtown, Johnson City, in the King Commons Park area directly behind Watauga Brewing Co., and across the street from the Johnson City Railroad Experience.

Can I Pick Up Paychecks / Reports / Tax Forms?

Absolutely! Clients are invited to pick up paychecks / reports / tax forms any time between 8am and 5pm, Monday through Friday. We are closed for some National holidays, so make sure to check our Google listing for any updates. Make sure you grab a PayDay candy bar on your way out!

Will You Deliver Paychecks to My Business in Greeneville?

Any paychecks that need to be delivered to Greeneville businesses are sent via UPS, FedEx, or USPS. We also encourage our clients to pick up paychecks when convenient to save on shipping costs. If unexpected circumstances require that paychecks be hand delivered to ensure employees are paid on time, we are happy to send a Time & Pay representative!