Time & Pay: Your Trusted Payroll Partner

Payroll is personal — and so is our service. With tailored solutions and guaranteed compliance, we deliver more than you'd expect from a payroll partner.

Why Choose Time & Pay?

Since 1992, we’ve helped businesses streamline payroll, stay compliant, and reclaim their time.

What makes us different?

✅ We take the time to understand your business. No one-size-fits-all solutions here.

✅ We build a payroll process tailored to your needs and workflows.

✅ We back it up with real support from people who know your name.

Say goodbye to payroll headaches.

Say hello to more time, fewer errors, and peace of mind.

Focus on what matters most — growing your business.

Get Pricing Today

Ready to simplify your payroll and HR processes? At Time & Pay, we tailor our services to meet your unique needs. Let us show you how we can add value to your business. Get a quote now and decide if you'd like to continue the conversation!

Compliance

Our innovative solutions ensure accuracy and compliance, saving time and money. Say goodbye to IRS penalties.

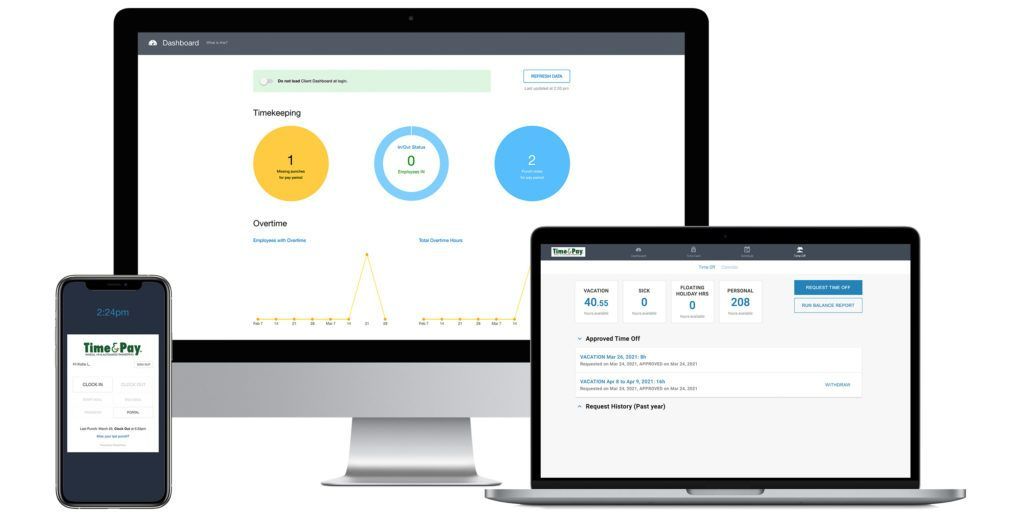

Efficiency

Our system quickly calculates hours and generates paychecks. Eliminate manual data entry for more time on important tasks.

Peace of Mind

Our team of experienced professionals will handle payroll so you can focus on running your business efficiently.

Simplify Payroll & HR

Our Services

Payroll & Tax Services

Efficient payroll processing tailored to your needs with guaranteed compliance.

Time Management Systems

Human Resources Management

Cloud-based HR tools and complimentary consultation for your business.

Benefits & Insurance Management

Benefits enrollment, administration, and compliance tools

What Our Clients Say

Client Testimonials

Having Time & Pay as a payroll service has been a wonderful partnership. Their customer service, punctuality and attention to detail have surpassed our expectations and we are glad to have them as a partner in conducting all of our payroll functions. I would highly recommend their services to companies, large and small.

We find your integrated timekeeping and payroll easy to use and more accurate than the time sheets we were using. My time is now freed up to take care of my patients and other aspects of my business. Thanks for making the transition to outsourcing my payroll easy and cost effective.

Ready to Simplify Payroll?

Let Time & Pay show you how easy payroll can be. Contact us today for a free quote or to learn more about our services.