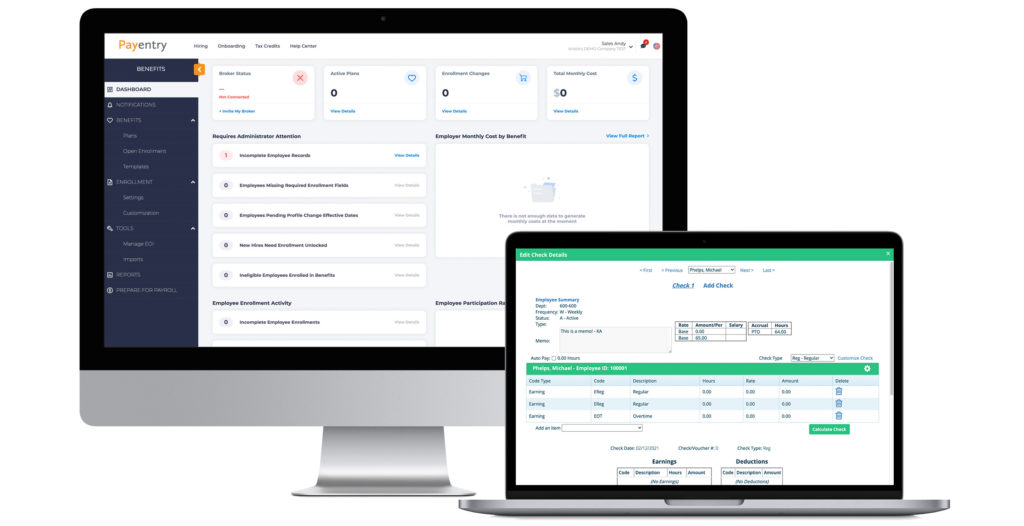

Benefits and Insurance Admin Support

Payroll is so much more than producing a paycheck! Managing employee benefit packages, including health insurance, supplemental insurance, retirement plans, and workers compensation can be a major burden.

Time & Pay can help automate and administer each of these items for you to save you time!

How We Help

Online Benefits Enrollment

Our benefits enrollment system makes it easy for your employees to manage their benefits through their employee self-service portal. Enrollments, updating qualified events, and managing dependents are simple, and information feeds directly into payroll.

Benefits Administration

We will reconcile your monthly statements from your insurance carriers to make sure each bill is accurate, and nothing falls through the cracks.

ACA Compliance

If you are an applicable large employer (ALE), compliance with the Affordable Care Act is essential. We will handle this process for you and make sure you avoid hefty fines from the IRS.

401K and Retirement Plan Administration

We will calculate employee and employer retirement plan contributions each pay period and can submit a file to make sure each plan is automatically funded.

Workers Comp Administration

We can report payroll information to your workers comp carrier so that premiums can be calculated, and submit a file to make sure those premiums are paid.